Merger & Acquisitions: How to choose an Advisor

The current global economic outlook continues to require businesses to take swift action to face an ever more competitive marketplace.

Companies need to identify proper strategies to face the turmoil, and unfortunately there isn’t a simple recipe.

Geographies will vary in maturity and ease of entry, thus necessitating different approaches and the options are several.

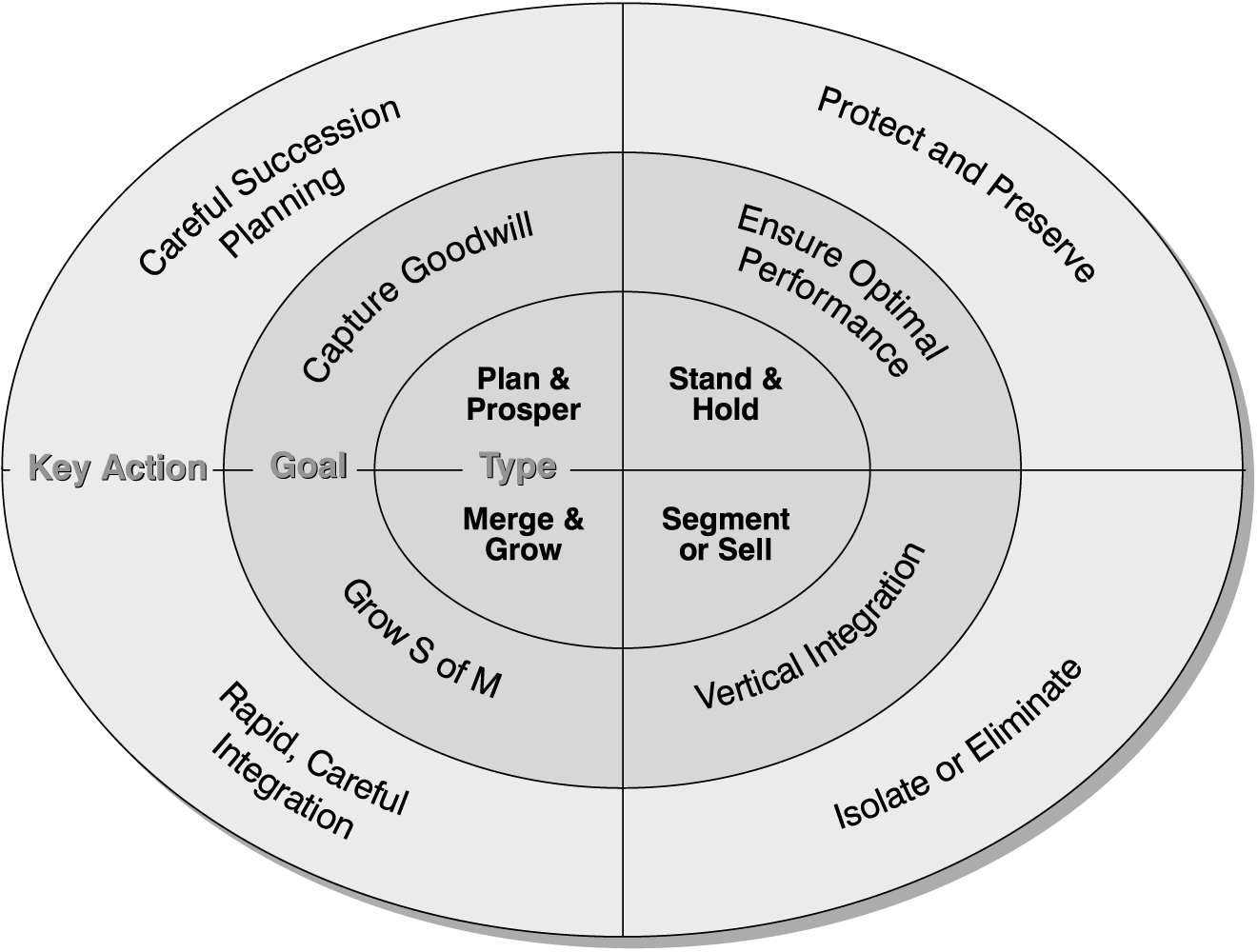

Often an option is to buy market share through acquisitions at local level, or fill a gap in offerings by taking over companies that have a compelling offering and have successfully addressed specific niches.

On the other hand, and at the same time, it might be necessary to refocus on the core business, divesting from selected countries or lines of business.

Smaller companies are increasingly under pressure: many do not have the critical mass necessary to compete on the global market, despite the opportunities offered by the global reach of the internet. Others have difficulty in obtaining adequate financial support from the banking system as investors are becoming more conservative and risk averse, especially if they do not see a viable exit strategy within a reasonable time horizon.

Still other small-medium sized businesses may find themselves without an acceptable management succession or transition plan, and their founding entrepreneurs may consequently want to look at capitalizing on the goodwill created over the years, selling their business to a large and well established group with an international footprint.

If on one hand large corporations can rely on top class advisors for major transactions, when it comes to niches or what we like to call surgical operations, where knowledge of the market place, the network of relationships, the ability to assess not only the strategic but also the human fit, and the ability to move quickly is critical, appropriate counsel is far from plentiful.

Small/medium businesses either fall below corporate bankers’ radar screens or find that bankers’ fees are far from affordable when they look to identify a potential partner with whom to merge or sell their business.In the Hightech Industry, where intellectual capital and the generation of services revenues are now central, the key asset is represented by people.

In the Hightech Industry, where intellectual capital and the generation of services revenues are now central, the key asset is represented by people. In making an M&A transaction successful, not only in financial terms, but in real outcomes, people play a key role.

To help devise their M&A strategy, such technology businesses therefore require professional advice provided by independent consultants with an established record in the evaluation of technology executives, coupled with real business acumen.

Advisors must have some key attributes:

1. Market knowledge

A high degree of intimacy with the market, both in terms of players as well as key decision makers, thus being able to quickly identify potential interlocutors that might be interested in a transaction and could be a good strategic fit for the kind of deal the client is envisioning.

2. Ability to assess People and Businesses

Financials are key in evaluating a business, but often the figures have to be interpreted far beyond their extrinsic value, and have to be put in perspective and benchmarked with indicators in similar companies. In addition – and often more important – it is necessary to assess the management, in particular the sales and delivery team, to predict the ability of the company to continue to perform or to explain why it has not performed in the past.

3. Direct Connections with Key Decision Makers

While the identification of the relevant target could be an exercise that could be done on paper, contacting potential interlocutors, especially in a very confidential way, has to be carefully handled. It is important that the Advisor not only knows how to approach these people, but possibly knows them already and has a private and direct access to them.

4. Attitude to mediation and formulation of a compelling proposition for both parties

A successful M&A transaction not only requires a win-win compelling proposition which addresses the key requirements of each party, but also mediation from the personal perspective of the respective interlocutors, in order to take into consideration soft factors which can often be critical .

5. Agility and responsiveness of an experienced and dedicated Senior Partner

In dealing with M&A transactions, speed and responsiveness is essential as well as agility and availability of an experienced Advisor used to dealing with critical missions in a very delicate context. While the study phase could be performed by a research team the approach and deal construction phase are better managed by a third party, perceived as senior, well respected and credible in providing relevant advice and who manages confidentially the most delicate phases, making himself available to assist without any sort of constraint.

6. High Confidentiality

On occasions this kind of process requires the highest discretion, even non-disclosure in the first instance of the real reason for the contact and certainly the name of the client, as often there is a requirement not to make public the decision to acquire or sell. To maintain strict confidentiality and avoid unnecessary leakages it is important to limit the number of targets, and consequently it is even more important to be able to make an intelligent selection beforehand.

7. Prior practical experience

Having the services of an Advisor who has hands-on experience of negotiating M&A agreements is clearly an advantage, and if such experience is within the technology sector and brings a genuine ability to correctly estimate the value of intellectual assets and likely recurring revenues, the impact may be critical.

The cost of such advice presents other problems. Executives are concerned about appointing Advisors as they are afraid of committing to pay large retainers: they prefer to pay only on success. On the other hand, for a skilled Advisor, time is his the only asset. To ensure the engagement of senior people on a professional basis a minimum retainer has to be committed.

The total fees for such advice follow certain norms. The range of fees is between 2-5% of the deal value, depending upon size, complexity and other issues, for example, constraints in considering components of the transaction such as payment in shares, refund of loans, etc.

It is customary to have a minimum success fee that is applicable in case for instance the price paid is negative, in other words if the seller has to pay a dowry to the buyer to take over the company.

We, at Hightech Partners – ITP, have been involved for years in advising our Clients about many of the issues raised above. In the last couple of years we have consolidated our thinking into a practice, with a standardized although flexible offer, being convinced that we are fully equipped to address this market need as a complementary service to our core Executive Search and Assessment business.

We aim to be competitive, by charging a minimum retainer fee up front, with the rest being paid on success and at a rate below those charged by banking Advisors.

We have been in the technology sector for more than 25 years and have witnessed the emergence of intellectual assets and services revenues as determining factors of business value. Our customer base and record in the selection and assessment of executives provide us with practical skills. And our Partners have themselves negotiated transactions in their past as executives of leading companies. We believe our firm is particularly suited to providing advice in the field of M&A.

For further information on this and related topics please contact us either via mail,

© Copyright Hightech Partners